Customer Experience Strategy for Target | Design research, experience strategy, and concept development for omnichannel in-store retail experiences.

Target: Role of Digital In Store

The past several years have witnessed dramatic changes to the way we shop. Links between digital and physical retail experiences are proliferating, and guests are more comfortable than ever shifting between modes. To create a holistic and seamless guest experience, Target is rethinking the role of digital within its physical stores. How can strategic links be built between its physical and digital ecosystems in a way that is uniquely Target?

Target approached 2x4 to conduct research and provide foresight into how Target might more seamlessly digitize their in-store retail experience. I was a strategist during this project, responsible for conducting rigorous research, generating insights, foresights, and digital strategy for the client, and working with designers to prototype and visually realize this digital strategy.

Category: Strategic Forecasting

Skills: Digital Strategy, Trend Research, Concept Development

Timeframe: Apr. 2022 - Nov. 2022

Context: 2x4 Inc.

Role: Design Strategist

01 Digital Futures & Trends

The New Normal

Though pre-pandemic trends indicated a rise in retail hybridization, the pandemic accelerated adoption of digital technologies to optimize retail experiences.

Retail Trends: Digital in Physical

Recent years have seen a broad exploration around the role of digital in physical stores, including immersive installations, in-store digital product finders, augmented reality product trial, and digital social connectivity. These have been adopted by companies such as Nike, Sephora, and Samsung.

Retail Trends: Low Touch Technologies

The Covid-19 pandemic accelerated adoption of low-touch digital technologies in retail settings, including QR-codes, instant delivery, fulfillment, automated kiosks, and contactless experiences.

Retail Trends: Spatial Digitization & Activation

Retailers have been experimenting with integration between digital services and physical spaces, including the public installation of QR codes, spatial activations, and virtual reality.

02 Landscape Analysis

Competitive Landscape

Target’s in-store experience needs to address the new normal–a hybrid shopping experience that blends together online and offline. By leveraging the store as a space for guests to shop using digital tools, messaging, and apps, Target will position itself as an innovator among big-box retailers.

We analyzed the hybrid strategies of the below retailers, categorizing them by their spatial qualities and their robustness. These criteria provide an indication of the intent of a given digital strategy, i.e. spectacles meant to entertain guests or services meant to optimize guest experiences.

Walmart

Amazon

Costco

Kroger

Ikea

Nike

Home Depot

Walgreens

Dollar General

Lowe’s

JoAnn

Digital Infrastructure: Hallmarks of Retail

Below details further research on cornerstone digital technologies and infrastructure that are not only hallmarks of current hybrid retail, but also present future opportunities.

Digital Design Breakdown

The graphic on the right dissects not only which digital media are coming to dominate the in-store retail experience, but also details specific features and design details within them that will come to prevail.

03 Target — Analysis

Competitor Analysis: Digital Integration

Target, however, is lacking compared to competitors when it comes to digital innovation and integration in physical spaces. These are as follows:

Real-time data (med.)

Seamless shopping (high)

Product education (high)

Integrated service tools (med.)

Interactive product display (med.)

Interactive demos (med.)

Customer Analysis: Target

To better understand the important of digital integration with physical retail, we started by analyzing Target’s customers and how digital integration might be important to them.

From our analysis, including stakeholder interviews and Target’s own customer research, we discovered that omnichannel guests tend to be Target’s best guests, making the relationship between digital and physical especially critical.

Target Infrastructure

Though Target does possess common hallmarks of digital infrastructure, such QR-codes and an app, the integration between digital services and in-store experiences is convoluted, fractured, and inadequate to facilitate customer engagement or even a seamless customer experience.

In terms of digital innovation for hybrid retail experiences, Target seems to struggle to experiment with novel interactional technologies and tends to lag behind competitors.

How might we address insufficiencies within Target’s digital strategy and provide a framework for growth?

Given the aforementioned research into Target’s digital strategy and identification of areas of improvement through potential digital technologies, below we provided the client with recommendations for opportunities and potential strategies they might employ to position Target as a digital innovator in the retail space.

04 Outcome I: Digital Innovation Strategy

05 Outcome II: Digital Spatial Strategy

Digital Strategy

The digital infrastructure implementation strategy proposed to the client was largely based on our competitive analysis, in which we analyzed how scale is used to realize a variety of digital experiences from immersion to convenience. Therefore, to facilitate a seamless in-store hybrid experience, we suggested to the client that the larger an experience is in scale, the less frequent it should be and the smaller an experience is in scale, the more frequent it can be.

Though several emerging technologies are being experimented with in the retail space, as demonstrated above, our strategy was primarily surrounding the implementation of screens as they currently present the most versatile medium of digital infrastructure.

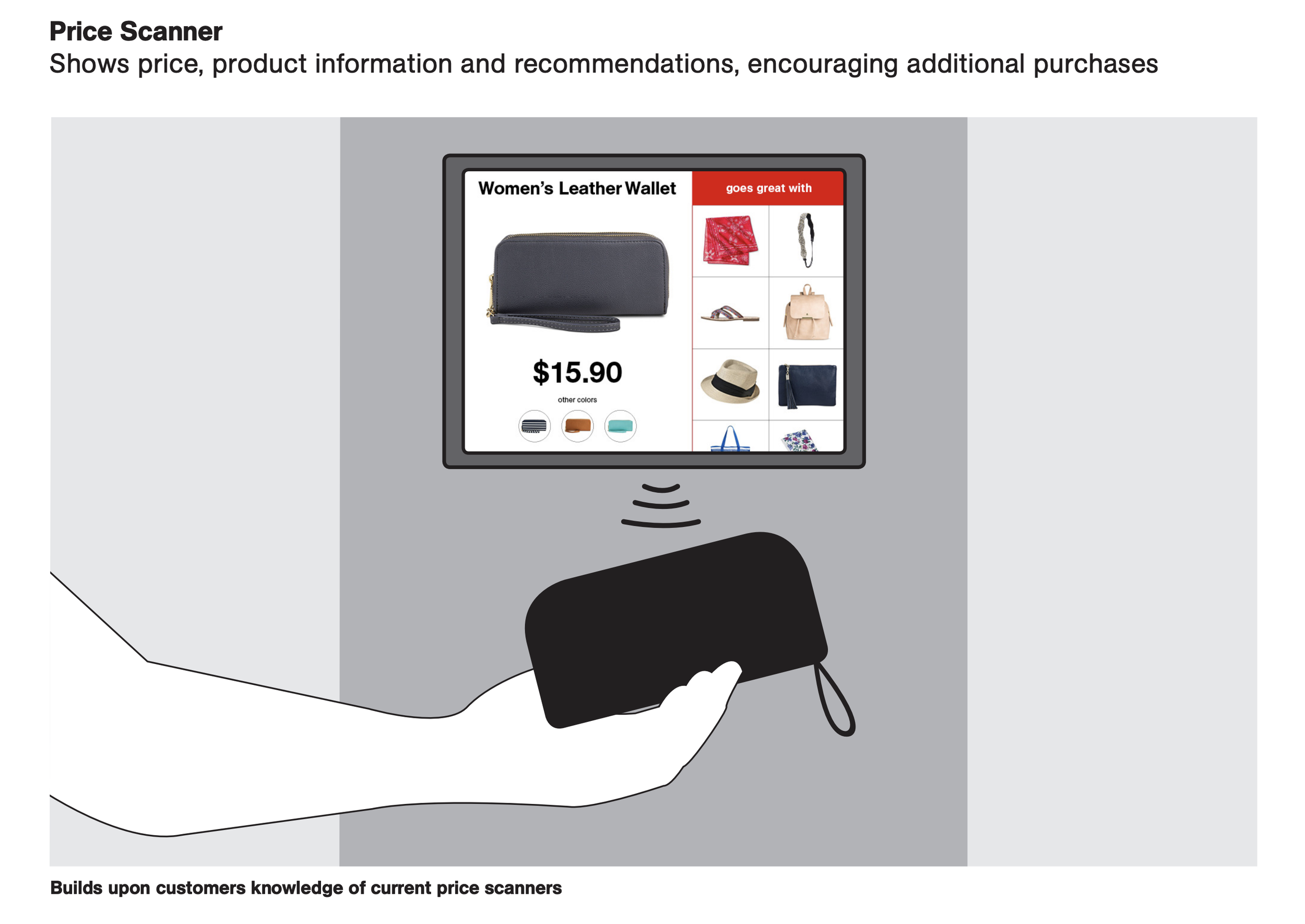

In this section, we also presented the client with visualized concepts of example in-store digital services and features. I was part of the team that worked closely with designers to help realize these concepts.

Small-Scale Digital: Screens

Small-scale digital is best placed where maintaining space for product is crucial, typically at key display nodes while fitting easily on tables, pedestals, and shelves. Hardware is rechargeable and easy to move as often as needed.

Small-Scale Digital Concepts: Screens

Small-scale digital is best used to highlight products in the immediate vicinity. This size is great for simple, straightforward messages and works well for minimal amounts of guest interaction.

Medium-Scale Digital

Medium-scale digital should be limited in quantity in each category, fitting on endcaps, free-standing, or hung from racks. Medium-scale digital is hard-wired and can be moved overnight.

Medium-Scale Digital Concepts: Screens

Medium-scale digital is best used to highlight a group of products. This size is ideal for touch interaction and works well with more in-depth experiences that communicate moderate amounts of information.

Large-Scale Digital

Large scale digital is located at perimeter walls in signature categories (Apparel, Beauty, Seasonal, & Home). Large wall projections feature brand stories that add context to the category they are positioned in.

Large-Scale Digital Concepts: Screens

Large-scale digital is best used to inspire and create a brand focused environment. These displays are out of reach of customers and do not offer any interaction. The content is mostly imagebased and is the least complex of the three sizes.

06 Takeaways & Projections

Projections

Estimated 8% growth over next 10 years for in-store retail experiences

Increased customer satisfaction

Fully integrated CX experience

Increase in-store app usage by 22%

Decrease in Locate moment duration by 18%

Takeaways

Omnichannel is the future of retail, in-store and out-of-store

For big-box retailers, product finding and deal advertising are the most important needs

Omnichannel strategy should be defined by scale vs. frequency of in-store digital experience

Visual consistency between analog and digital channels is critical to omnichannel retail